1.

Introduction

blueSeed Plan is a productivity desk application developed to help users

building up a Business Plan, specifically, within the main areas of this

process, would assists the user in foreseeing budgets and projections to show

financial outcomes of an already ongoing project or one under discussion. An

essential tool for entrepreneurs or businessmen, taking their first steps in a

new undertaking or start-up, to evaluate its viability. It is very helpful when

carrying out financial, economic or costs analysis, above all in the case you

need to address potential investors interested in your project in funding

rounds, for example.

Taking into account common

data from the accounting records in the administration software or ledgers of

the company (sales, staff costs, inventory, financial expenses and revenues,

etc.), this app will lead you through the process of making up your own

financial forecasts in a very easy way. You will be able to produce some

projected statements as: Income Statements, Balance Sheets, Cash Flow

Statements, Break Even Analysis and Sources and Uses of Funds.

Besides the

accounting information, blueSeed Plan would ask you to introduce some global economic

variables such as CPI and Market Interest Rate. Depending on the exactitude of this

values and enterprise operational ones (you will find different sections, in

the user interface, where you will be asked to fill diverse kind of data a

company works with), you would have more accurate figures.

The reports issued by

this app would describe in numbers the outcome of your business strategies and

policies. They would help to provide an operating plan to assist you in running

the business and improve your probability of success.

The application is

divided in various sections:

2.

Global Variables

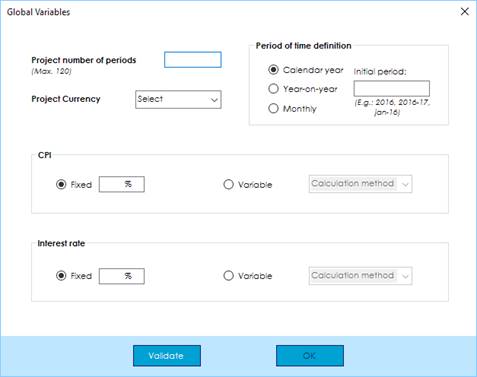

The first time you

run the application or when you select to create a new document (or Project as it is called by the program),

you would be asked to introduce the Global Variables for the current document

which are: number and kind of periods, currency, CPI and Interest Rate of your

country or geographical area.

They will be used to

calculate price variation through the inflation rate, financial expenses and

revenues, and compound interest for all products in the company portfolio.

Hereunder, you can

see a screenshot of the first form and dialog boxes where you should insert the

figures:

You should introduce

data in the following fields:

3. Project Number Of Periods

Within this part you

should write the number of periods (years or months) your project will have, with

a maximum of 120. You should put an integer in the textbox without comas or any

other character.

This number would be

the time horizon you will set for all projections and must fit our and the

target audience expectations for this exercise.

4. Period Of Time Definition

As you can see in the

previous image there are three format options for each time unit (either year

or month) of the project:

·

Calendar year: periods of time

started in January and ended in December (natural year), you should put the

four digits of the initial year, for example:

“2016”, “1981”.

·

Year-on-year: this biannual format

can be used for not natural years, would be the case of fiscal or economic

years starting in a different month than January and not ending in December, the

way to write them is putting the four digits of the first year, hyphen followed

by the last two digits of the second year, for example: “2016-17”, “1981-82”.

·

Monthly: you can use this

format if you want to set a period of time lesser than a year, then select a

starting month and have in mind this time subdivision would be maintained

through all the time horizon. You should write the first three letters of the

starting month, then a hyphen followed by the last two digits of the initial

year, for example: “ene-16”, “jun-16”.

When you choose this

option, the application will automatically add a column with aggregated figures

in some of the reports produced, such as Income Statement, Balance Sheet, etc.

If you leave blank

this textbox the program will name “Period” to all time units and will number

them consecutively.

5. Currency

Although it has no

impact in any calculation made by the application, you can choose a name or a

symbol for the currency of the project, either one of which appear within the dropdown

box in the related subject or clicking “Other” in the same dropdown box and

writing the desired name in the appearing textbox.

The selection will

appear in all the reports produced.

You can also leave it

blank, in that case there will be no reference to any currency in the issued

reports.

6. CPI

CPI (or Consumer

Price Index) is a variable that would affect to several items in the project, such

as products sales prices, wages, purchasing and overheads, just like what

inflation reflects when price indexes increases.

For our project, it

can be a signed or unsigned integer or floating with two decimals at best.

Furthermore, this rate can be fixed for all the project, meaning that price

variation will be the same for all periods, or variable, you can put a

different rate for each period.

If you want a fixed

CPI you should put the desired estimated figure in the textbox labeled for that

purpose, on the other hand, if you want a variable rate the program gives you

four alternatives for its calculation:

1.

Manual

When you click on

this dropdown box item, a new form will appear with a blank table where you can

manually insert CPI figures for each period. They can be signed or unsigned

integers or floating numbers with decimals.

2.

Linear

Coefficient

When you choose this option, the form shows a textbox

where you can put the CPI rate for the first period (rate expressed in

percentage), and then the increase or decrease to apply in all other periods (in

this case this rate should be expressed in per-one, e.g. for a 10% rate change

you should write “0.01”).

The application will calculate future rates for each

period of time applying that linear coefficient each time over the previous.

3.

Data

Import

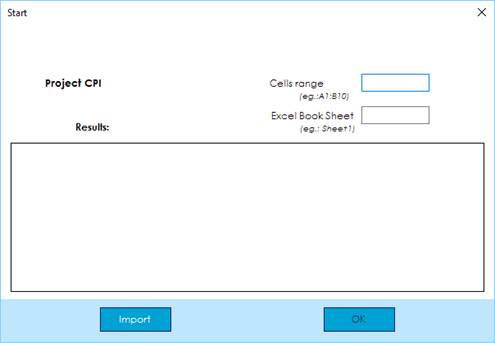

blueSeed Plan allows data import from an Excel file. So once you

have chosen that option in the dropdown box and an Excel file in the subsequent

window, you will see a similar form to the previous ones:

First of all, you should put the cells range containing

the data to import in the textbox labeled that way (data can only be numbers,

this option does not accept text), and it can have several rows and columns. If

the range has more than one row, the application takes values from left to

right and top to bottom.

Next step is to write the name of the Excel worksheet

in the next textbox under the previous one.

Then you click on “Import” and wait until the blank

table is filled with the numbers in the Excel file (this process could take

long if the selected range is too big).

If everything has worked out correctly and the figures

in the table are the ones you wanted, you can click on “OK”, otherwise you can

repeat the process checking the range and name of the Excel worksheet.

4.

Time

Series

Last item in

the dropdown box is “Time Series”. blueSeed Plan provides another

calculation method to estimate CPI rates in the Project. It do it according to historic

data trends, adding every new obtained value to the calculation of the next

period of time rate.

Once you have

the Excel file, where you keep the data series, selected (cells values can only be numbers, this

option do not accept text) you will see a similar form to the previous one. Here

you will first have to put the cells range in the upper textbox, it can have

several rows and columns, if it has more than one row, the application takes

values from left to right and top to bottom. Then you write the name of the

Excel sheet in the bottom textbox.

You click on “Import and calculate” and wait until the

blank table is filled with the numbers calculated by the application (this

process could take long if the selected range is too big).

If everything has worked out correctly and the figures

in the table seem to be right, you can click on “OK”, otherwise you can repeat

the process checking the range and name of the Excel worksheet.

7. Interest Rate

Interest Rate is a

global variable (it would be the reference value for all the interest rates

needed in the project) and would affect to several items in the project, such

as leasing, renting, loans or credit lines. It can be a signed or unsigned

integer or floating with two decimals at best.

Besides, this rate

can be fixed for all the project, meaning that price variation will be the same

for all periods, or variable, you can put a different rate for each period.

If you want a fixed Interest

Rate you should put the desired estimated figure in the textbox labeled for

that purpose, on the other hand, if you want a variable rate the program gives

you four alternatives for its calculation:

1.

Manual

When you click on

this dropdown box item, a new form will appear with a blank table where you can

manually insert Interest Rate figures for each period. They can be signed or

unsigned integers or floating numbers with decimals.

2.

Linear

Coefficient

When you choose this option, the form shows a textbox

where you can put the Interest Rate for the first period (rate expressed in

percentage), and then the increase or decrease to apply in all other periods (in

this case this rate should be expressed in per-one, e.g. for a 10% rate change

you should write “0.01”).

The application will calculate future rates for each

period of time applying that linear coefficient each time over the previous.

3.

Data

Import

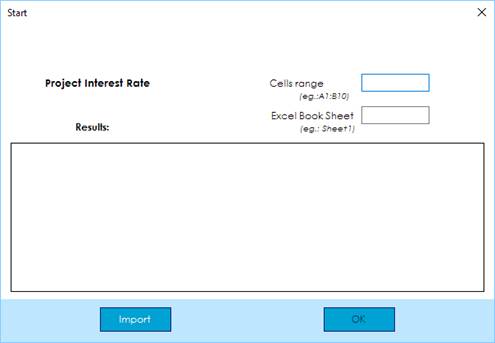

blueSeed Plan allows data import from an Excel file. So once you

have chosen that option in the dropdown box and an Excel file in the subsequent

window, you will see a similar form to the previous ones:

First of all, you should put the cells range

containing the data to import in the textbox labeled that way (data can only be

numbers, this option does not accept text), and it can have several rows and

columns. If the range has more than one row, the application takes values from

left to right and top to bottom.

Next step is to write the name of the Excel worksheet

in the next textbox under the previous one.

Then you click on “Import” and wait until the blank

table is filled with the numbers in the Excel file (this process could take

long if the selected range is too big).

If everything has worked out correctly and the figures

in the table are the ones you wanted, you can click on “OK”, otherwise you can

repeat the process checking the range and name of the Excel worksheet.

4.

Time

Series

Last item in

the dropdown box is “Time Series”. blueSeed Plan provides another

calculation method to estimate CPI rates in the Project. It do it according to

historic data trends, adding every new obtained value to the calculation of the

next period of time rate.

Once you have

the Excel file, where you keep the data series, selected (cells values can only be numbers, this

option do not accept text) you will see a similar form to the previous one.

Here you will first have to put the cells range in the upper textbox, it can

have several rows and columns, if it has more than one row, the application

takes values from left to right and top to bottom. Then you write the name of

the Excel sheet in the bottom textbox.

You click on “Import and calculate” and wait until the

blank table is filled with the numbers calculated by the application (this

process could take long if the selected range is too big).

If everything has worked out correctly and the figures

in the table seem to be right, you can click on “OK”, otherwise you can repeat

the process checking the range and name of the Excel worksheet.

8. Project Start

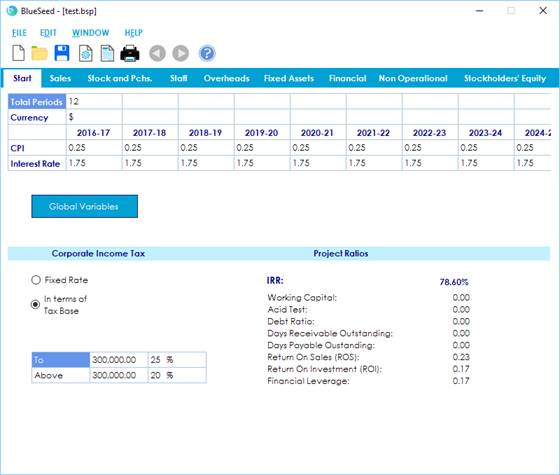

Once you have all global variables well defined within

the first form, you should validate clicking on the corresponding button. If

there is no errors, “Accept” button is activated so it can be clicked to

continue with following stage in the process.

Now you have press the button, current window disappears

and the main window of the program is showed. Here you will introduce specific

data of the project.

You can see a detail of this form hereunder:

As you can realize this form has several tabs in it. The

one selected is the one is opened in first instance every time you start a new

project (“Start”).

First thing you can appreciate in the upper part is a

table with a summary with the numbers you have already introduced in the first

window. This table cannot be modified without going back to the first form, and

for that you would have to click on the “Global Variables” button below.

In the case you could not see all the columns or rows

of this table, you can click on it and move through the cells with the arrow

buttons in your keyboard.

If you are compelled to change any of those first

variables, you should bear in mind that depending on what changes are you going

to do, they may affect to the information you have already put in the main

window (in any of its tabs) and in some cases lose some part of it.

In the lower part of the tab you can see two captions:

Corporate Income Tax, which we explain in the next section, and Project Ratios where

you can find a list of several financial rates you can use for your analysis. This

ratios are refreshed every time we ask for a report in the application menu or

tool bar.

Corporate

Income Tax

In this block you can define sort of and rates for the

Corporate Income Tax. If it is a fixed rate type or it is a tax bracket one,

then select bracket ranges and income tax rate for each one.

For fixed rates, you just have to write the desired

figure in the textbox of the window that will appear when we get in “Fixed Rate”

box, then you click on “OK” and the number will be displayed in the textbox. It should be an unsigned integer or

floating with two decimals at best.

For tax bracket type, first step is to select the radio

button labeled as “In terms of Tax Base” and a dropdown box and two more

textboxes will be displayed. To define the tax bracket structure you may

proceed as follows:

-

The dropdown box lists two items: “To” and “Above”. Every time you want

to set a new bracket you have to select “To” except in the case of the last

bracket, where you have to clink on “Above”, thus adding last row of the table

and closing the bracket structure.

For instance, for a tax structure of three brackets: 0-100,000,

100,001-300.000 and 300,001- ∞, you would have to

put “To” in the first two segments, and “Above” in the last one.

-

In the textbox under the dropdown box, you have to write the figure corresponding

to the upper limit of the Tax Base (net income before taxes) Bracket, except for the last one where

you leave the previous number as the lower limit in a bracket that has no upper

end (or it has ∞).

Following prior example: 100,000 for the first one,

300,000 for the second one, and you will leave 300,000 for the last one.

-

Finally, you can insert tax rate

for every bracket in the second textbox, it should be an unsigned integer or

floating with two decimals at best.

For example, in a tax

structure which seeks to benefit low profits: 20% for the first bracket, 25%

for the second and 30% for the last one).

Once you have the values you require in the

corresponding boxes, you click on “Add to list” every time you want to

introduce a new bracket in the table. Any time you do it for the last segment

of that range (when you have “Above” selected in the dropdown box), you will

see this button and the one named “Delete row” will disable, as you have

already completed the tax income bracket structure.

To revert that situation you have to click on “Fixed

Rate” radio button and the table and boxes will disappear.

Before having introduced the last bracket in the table,

when it is not blocked and accepting more fields, you can delete rows of that

table by just selecting the one you want to delete and clicking on “Delete row”.

Now you have to

continue introducing data in the next tabs, so we will go over each one of the

in the following sections.

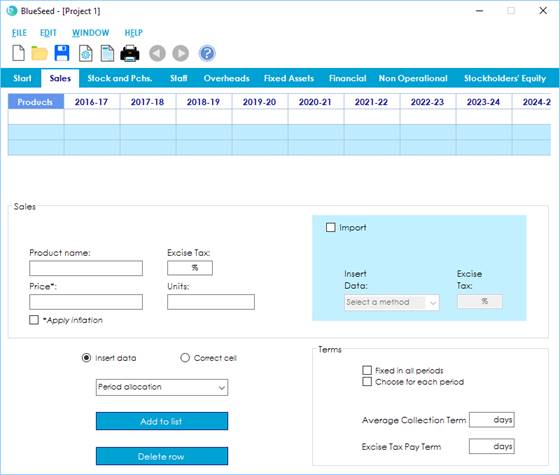

9. Sales

Sales tab shows the

following view:

First thing you see

is a blank table (with the exception of the headers on every column) where you

will see displayed every data you will be introducing afterwards: name of the

products (in the first column), sales amounts by period of time (next columns

with the periods names in the header), collection and excise tax pay terms by

period of time (which will be shown in the last two blue rows) and, finally, excise

tax rate by product (in the last column of the table, which cannot be viewed in

upper image).

In the case you could not see all the columns or rows

of this table, you can click on it and move through the cells with the arrow

buttons in your keydoard.

There are two ways to

insert data in the table: manually one by one or importing values from an Excel

worksheet.

In the first case you

should fill the different dialog boxes: product name, price (not excise tax

affected), excise tax rate and number of units sold. Then you should allocate a

period of time in the dropdown box just over the “Add to list” button.

If you want product price

to be affected by CPI (the value you have introduced in the first form), we

tick on the checkbox labeled “Apply inflation”. The way in which the program take

into account the inflation rate is to apply a coefficient to the price you have

written in corresponding textbox (which should be a reference from the previous

period to the first one in the project). That coefficient is the result of

multiply all the CPI rates (the ones shown in the table in the firs tab) from

the first period of time to the period you have currently selected.

Now that you have all

the data you want to introduce in the table and the period of time where you

want to do it, you can insert that values by clicking on “Add to list” button.

Average collection

and Excise Tax pay terms are added separately selecting one of the two options

in the “Terms” section, fixed for all the project, with means they would be the

same terms in all the periods of time, or you can select to put different terms

period by period (in this case you will see that the dropdown box used to

allocate periods is enabled).

To correct any of the

figures you have already introduced in the table, you count with two options: you

can delete a complete row (or product) just by selecting it and clicking on “Delete

row” button, or you can correct individual values cell by cell.

To change values in

only one cell you first have to select the radio button labeled as “Correct

cell”, then you have to select the cell by clicking on it and press “Correct”

button. A new window will appear where you have to introduce a new value, click

“OK” and the cell will show amended figure.

Import

As explained before, the application allows data

import from an Excel worksheet, as an alternative to inserting numbers one by

one as described in the manual method above.

To start this option you have to check “Import” box, write

excise tax rate if applicable within the textbox enabled, and then select one

of the two methods the dropdown box offers to the users:

1)

Data Import

First option is plain data import, once you have

chosen the Excel file where you have the information you want to import, in the

dialog window appearing after clicking on the corresponding dropdown box item,

you will see a similar form to the previous ones (CPI and Interest rate import

methods), and also process to follow is quite similar.

First of all, you should put the cells range

containing the data to import in the textbox labeled that way, but here there

is a difference this time in the way the values has to be positioned. They

should be organized in a similar way the application ask for values when using

the manual method, so there are two key factors to have in mind before organize

the information in the Excel worksheet:

I.

First column of the range should

contain the name of the products (with as many rows or fields as you need).

II.

After this first column, they

should follow pairs of columns for each same period of time (product price and

units sold, and should be as many pairs of columns as periods of time in the

project), with the same number of rows than the first one.

Next step is to write the name of the Excel worksheet

in the next textbox under the previous one.

Then you click on “Import” and wait until the blank table

is filled with the names and numbers in the Excel file (this process could take

long if the selected range is too big).

If everything has worked out correctly and the values

in the table are the ones you wanted, you can click on “OK”, otherwise you can

repeat the process checking the range and name of the Excel worksheet.

2) Time Series

The second item

listed in the “Insert data” dropdown box within import section is “Time

Series”. blueSeed Plan provides another

calculation method to estimate total sales figures for each period of time (for

only one field or product each time). It do it according to historic data

trends (data provided by the user), adding every new obtained value to the original

series and using increased set of values for the calculation of the next period

of time rate.

Once you have

the Excel file, where you keep the data series, selected (cells values can only be numbers, this

option do not accept text) you will see a similar form to the previous one.

Here you will first have to put the cells range in the upper textbox, it can

have several rows and columns, if it has more than one row, the application

takes values from left to right and top to bottom.

Then you write the name of the Excel sheet in the bottom

textbox.

It is important to note that, firstly, the program asks

only for historic sales figures (not prices at all, and not units numbers yet),

and no need neither to introduce names of the products in the first column as

before (application will assign a default name).

You click on “Import and calculate” and wait until the

blank table is filled with the numbers calculated by the application (this

process could take long if the selected range is too big).

When the program has finished calculation of the total

amount of sales for each period of time, it announce the user he could now

introduce total units sold in for each period, another table appears where we

can introduce, manually this time, the total quantity numbers for each period

(this table can be left totally blank as it has not impact in sales now that

the first table is completed).

If everything has worked out correctly and the figures

in both tables seem to be right, you can click on “OK”, otherwise you can

repeat the process checking the range and name of the Excel worksheet.

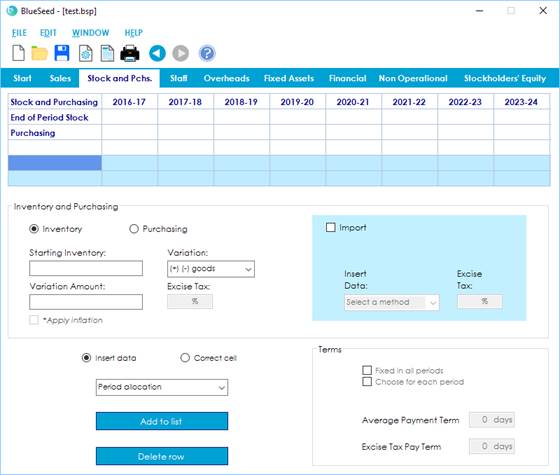

10. Stock And Purchasing

Stock and Purchasing tab has the following appearance:

Just like in the previous

tab, first thing you see is a blank table (with the exception of the headers on

every column and two first rows). Here you will see displayed every data you

will be introducing afterwards: end of period goods stock figures (in the first

row), name of the purchased products (in the first column under “Purchasing”

header), purchasing amounts by period of time (next columns with the periods

names in the header), average and excise tax pay terms by period of time (which

will be shown in the last two blue rows) and, finally, excise tax rate by

product (in the last column of the table, which cannot be viewed in upper image).

In the case you could not see all the columns or rows

of this table, you can click on it and move through the cells with the arrow

buttons in your keyboard.

To select the kind of

data you are working with, inventory or purchasing, you first have to click on

the consistent radio button, and follow as described in next paragraphs.

There are two ways to

insert data in the table: manually one by one or importing values from an Excel

worksheet.

In the first case you

should fill the different dialog boxes. When you are inserting inventory

figures you find a first textbox where you have to put opening balance in, beside

there is a dropdown box where you should specify during the period the goods

stock has increased or decreased, finally, in the textbox below you write the

amount of stock variation. Then you allocate the period of time to which the

data is related in the dropdown box just over the “Add to list” button.

Otherwise, if you are

introducing purchasing information, you first have to write the name of the

good in the upper textbox, then the purchased amount for that period, an excise

tax rate if applicable. Then again, you allocate the period of time to which

the data is related in the dropdown box just over the “Add to list” button.

If you want purchased

goods price to be affected by CPI (the value you have introduced in the first

form), we tick on the checkbox labeled “Apply inflation”. The way in which the

program take into account the inflation rate is to apply a coefficient to the purchased

total value you have written in corresponding textbox (which should be a

reference from the previous period to the first one in the project). That

coefficient is the result of multiply all the CPI rates (the ones shown in the

table in the firs tab) from the first period of time to the period you have

currently selected.

Now that you have all

the data you want to introduce in the table and the period of time where you

want to do it, you can insert that values by clicking on “Add to list” button.

Average and Excise Tax

pay terms are added separately selecting one of the two options in the “Terms”

section, fixed for all the project, with means they would be the same terms in

all the periods of time, or you can select to put different terms period by

period (in this case you will see that the dropdown box used to allocate

periods is enabled).

To correct any of the

figures you have already introduced in the table, you count with two options: you

can delete a complete row (or product) just by selecting it and clicking on “Delete

row” button, or you can correct individual values cell by cell.

To change values in

only one cell you first have to select the radio button labeled as “Correct

cell”, then you have to select the cell by clicking on it and press “Correct”

button. A new window will appear where you have to introduce a new value, click

“OK” and the cell will show amended figure.

Import

As explained before, the application allows data

import from an Excel worksheet, as an alternative to inserting numbers one by

one as described in the manual method above.

To start this option you have to check “Import” box,

write excise tax rate (just in the case you are working with in purchasing

choice) if applicable within the textbox enabled, and then select one of the two

methods the dropdown box offers to the users:

1)

Data Import

Subject to what kind of values you have chosen to

introduce, inventory or purchasing, the way the information has to be ordered

in the worksheet is going to vary, so we now are going to show you the two

different cases:

a)

Inventory

Once you have selected the Excel file in the window

appearing after clicking in the dropdown box item, you must follow next

instructions:

First of all, you should put the cells range

containing the data to import in the textbox labeled that way (data can only be

numbers, this option does not accept text), and it can have several rows and

columns. If the range has more than one row, the application takes values from

left to right and top to bottom.

Next step is to write the name of the Excel worksheet

in the next textbox under the previous one.

Then you click on “Import” and wait until the blank

table is filled with the numbers in the Excel file (this process could take

long if the selected range is too big).

If everything has worked out correctly and the figures

in the table are the ones you wanted, you can click on “OK”, otherwise you can

repeat the process checking the range and name of the Excel worksheet.

b)

Purchasing

Again, you have to choose the Excel file where you

have the information you want to import, in the dialog window appearing after

clicking on the corresponding dropdown box item, you will see then a similar

form to the previous ones (CPI and Interest rate, Sales import methods), and

also process to follow is quite similar.

First of all, you should put the cells range

containing the data to import in the textbox labeled that way, but here there

is a difference this time in the way the values has to be positioned. They

should be organized in a similar way the application ask for values when using

the manual method, so there are two key factors to have in mind before organize

the information in the Excel worksheet:

I. First column of the

range should contain the name of the purchased goods (with as many rows or

fields as you need).

II. After this first

column, they should follow columns with total amount purchased for each period

of time (not pairs of columns as in previous sections of the program), with the

same number of rows than the first one.

Next step is to write the name of the Excel worksheet

in the next textbox under the previous one.

Then you click on “Import” and wait until the blank table

is filled with the names and numbers in the Excel file (this process could take

long if the selected range is too big).

If everything has worked out correctly and the values

in the table are the ones you wanted, you can click on “OK”, otherwise you can

repeat the process checking the range and name of the Excel worksheet.

2) Time Series

This time, “Time

Series” option in this tab woks the same for inventory as for purchasing.

blueSeed Plan provides another

calculation method to estimate total figures for each period of time (for only

one field or product each time). It do it according to historic data trends

(data provided by the user), adding every new obtained value to the original

series and using increased set of values for the calculation of the next period

of time rate.

Once you have

the Excel file, where you keep the data series, selected (cells values can only be numbers, this

option do not accept text) you will see a similar form to the previous one.

Here you will first have to put the cells range in the upper textbox, it can

have several rows and columns, if it has more than one row, the application

takes values from left to right and top to bottom.

Then you write the name of the Excel sheet in the bottom

textbox.

It is important to note that, firstly, the program

asks only for historic figures (not prices and units numbers split, as in other

cases), and no need neither to introduce names of the products (in “Purchasing”

option) in the first column as before (application will assign a default name).

You click on “Import and calculate” and wait until the

blank table is filled with the numbers calculated by the application (this

process could take long if the selected range is too big).

If everything has worked out correctly and the figures

in the table seem to be right, you can click on “OK”, otherwise you can repeat

the process checking the range and name of the Excel worksheet.

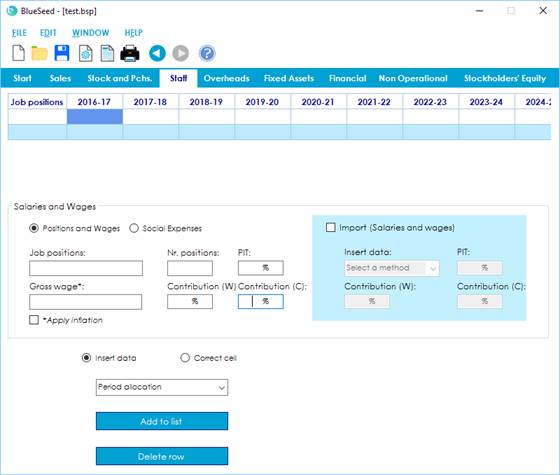

11. Staff

In this section, application

shows following parts:

Just like in previous

tabs, first thing you see is a blank table (with the exception of the headers on

every column). Here you will see displayed every data you will be introducing afterwards.

In the case you could not see all the columns or rows

of this table, you can click on it and move through the cells with the arrow

buttons in your keyboard.

In fact there will be

two different tables, one for the data when you are working in “Positions and

Wages” option, and other for the information in “Social Expenses” one.

Anyway, the

information you will see in both tables will appear in following order: job

positions or social expenses denomination (in the first column), wage and

salaries total amounts for any job position or total amount for any expense by

period of time (next columns with the periods names in the header), finally, only

for “Positions and Wages” option, Personal Income Tax (PIT) rate, worker

Contribution (W) rate, company Contribution (C) rate, would be displayed for

every job position, if applicable, in the last three columns of related table,

which cannot be viewed in upper image.

To select the kind of

data you are working with, positions and wages or social expenses, you first

have to click on the consistent radio button, and follow as described in next

paragraphs.

There are two ways to

insert data in the tables: manually one by one or importing values from an

Excel worksheet.

In the first case you

should fill the different dialog boxes. When you are inserting positions and

wages figures you find a first textbox where you have to put the name of the

job positions in, beside there is another text box where you have to write the

number of positions for each job in the firm, and under you have another

textbox to introduce gross wage for that position. There are three more

textboxes where you can put in, whenever is necessary, Personal Income Tax

(PIT), worker Contribution (W), company Contribution (C) rates. Finally, you allocate

the period of time to which the data is related in the dropdown box just over

the “Add to list” button.

Otherwise, if you are

introducing social expenses information, you just have to write the name of the

expense in the first textbox and the expense total amount for that period in

the one below. Then again, you allocate the period of time to which the data is

related in the dropdown box just over the “Add to list” button.

If you want wages or

social expenses to be affected by CPI (the value you have introduced in the

first form), we tick on the checkbox labeled “Apply inflation”. The way in

which the program take into account the inflation rate is to apply a

coefficient to the gross wage you have written in corresponding textbox (which

should be a reference from the previous period to the first one in the project).

That coefficient is the result of multiply all the CPI rates (the ones shown in

the table in the firs tab) from the first period of time to the period you have

currently selected.

Now that you have all

the data you want to introduce in the table and the period of time where you

want to do it, you can insert that values by clicking on “Add to list” button.

To correct any of the

figures you have already introduced in the table, you count with two options: you

can delete a complete row (or product) just by selecting it and clicking on “Delete

row” button, or you can correct individual values cell by cell.

To change values in

only one cell you first have to select the radio button labeled as “Correct

cell”, then you have to select the cell by clicking on it and press “Correct”

button. A new window will appear where you have to introduce a new value, click

“OK” and the cell will show amended figure.

Import

You can only use this option when working in “Positions and Wages” selection.

As explained before, the application allows data import from an Excel worksheet,

as an alternative to inserting numbers one by one as described in the manual

method above.

To start this option you have to check “Import” box,

write Personal Income Tax (PIT),

worker Contribution (W), company Contribution (C) rates if applicable

within the textboxes enabled, and then select one of the two methods the

dropdown box offers to the users:

1)

Data Import

First option is plain data import, once you have

chosen the Excel file where you have the information you want to import, in the

dialog window appearing after clicking on the corresponding dropdown box item,

you will see a similar form to the previous ones (CPI and Interest rate, Sales

import methods), and also process to follow is quite similar.

First of all, you should put the cells range containing

the data to import in the textbox labeled that way, but here there is a

difference this time in the way the values has to be positioned. They should be

organized in a similar way the application ask for values when using the manual

method, so there are two key factors to have in mind before organize the

information in the Excel worksheet:

I. First column of the

range should contain the name of the job positions (with as many rows or fields

as you need).

II. After this first

column, they should follow pairs of columns for each same period of time (gross

wages and number of posts for each position, and should be as many pairs of

columns as periods of time in the project), with the same number of rows than

the first one.

Next step is to write the name of the Excel worksheet

in the next textbox under the previous one.

Then you click on “Import” and wait until the blank table

is filled with the names and numbers in the Excel file (this process could take

long if the selected range is too big).

If everything has worked out correctly and the values

in the table are the ones you wanted, you can click on “OK”, otherwise you can

repeat the process checking the range and name of the Excel worksheet.

2)

Time Series

The second item listed in the “Insert data” dropdown

box within import section is “Time Series”. blueSeed Plan provides another calculation method to

estimate total wages figures for each period of time (for only one field or job

position each time). It do it according to historic data trends (data provided

by the user), adding every new obtained value to the original series and using

increased set of values for the calculation of the next period of time rate.

Once you have the Excel file, where you keep the data

series, selected (cells values can only be numbers, this option do not accept

text) you will see a similar form to the previous one. Here you will first have

to put the cells range in the upper textbox, it can have several rows and columns,

if it has more than one row, the application takes values from left to right

and top to bottom.

Then you write the name of the Excel sheet in the

bottom textbox.

It is important to note that, firstly, the program

asks only for historic wages and salaries figures (not individual wage nor numbers

of position to make a multiplication), and there is no need neither to

introduce names of the posts in the first column as before (application will

assign a default name).

Next thing you click on “Import and calculate” and

wait until the blank table is filled with the numbers calculated by the

application (this process could take long if the selected range is too big).

When the program has finished calculation of the total

amount of payroll for each period of time, it announce the user he could now

introduce total number of job positions for each period, another table appears

where we can write, manually this time, the total quantity numbers for each

period (this table can be left totally blank as it has not impact in sales now

that the first table is completed).

If everything has worked out correctly and the figures

in both tables seem to be right, you can click on “OK”, otherwise you can

repeat the process checking the range and name of the Excel worksheet.

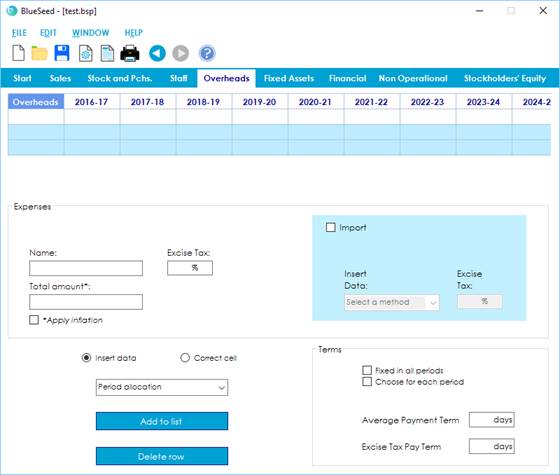

12. Overheads

“Overheads” tab

displays as follows:

Like it happened in

previous sections, first thing you see is a blank table (with the exception of

the headers on every column) where you will see displayed every data you will

be introducing afterwards: name of the expenses (in the first column), expenses

amounts by period of time (next columns with the periods names in the header), average

and excise tax pay terms by period of time (which will be shown in the last two

blue rows) and, finally, excise tax rate by expense (in the last column of the

table, which cannot be viewed in upper image).

In the case you could not see all the columns or rows

of this table, you can click on it and move through the cells with the arrow

buttons in your keyboard.

There are two ways to

insert data in the table: manually one by one or importing values from an Excel

worksheet.

In the first case you

should fill the different dialog boxes: expense name in the first textbox, excise

tax rate and expenditure total amount in the second textbox. Then you should allocate

a period of time in the dropdown box just over the “Add to list” button.

If you want expenses to

be affected by CPI (the value you have introduced in the first form), we tick

on the checkbox labeled “Apply inflation”. The way in which the program take

into account the inflation rate is to apply a coefficient to the total amount

value you have written in corresponding textbox (which should be a reference

from the previous period to the first one in the project). That coefficient is

the result of multiply all the CPI rates (the ones shown in the table in the

firs tab) from the first period of time to the period you have currently

selected.

Now that you have all

the data you want to introduce in the table and the period of time where you

want to do it, you can insert that values by clicking on “Add to list” button.

Average and Excise Tax

pay terms are added separately selecting one of the two options in the “Terms”

section, fixed for all the project, with means they would be the same terms in

all the periods of time, or you can select to put different terms period by

period (in this case you will see that the dropdown box used to allocate

periods is enabled).

To correct any of the

figures you have already introduced in the table, you count with two options: you

can delete a complete row (or product) just by selecting it and clicking on “Delete

row” button, or you can correct individual values cell by cell.

To change values in

only one cell you first have to select the radio button labeled as “Correct

cell”, then you have to select the cell by clicking on it and press “Correct”

button. A new window will appear where you have to introduce a new value, click

“OK” and the cell will show amended figure.

Import

As explained before, the application allows data

import from an Excel worksheet, as an alternative to inserting numbers one by

one as described in the manual method above.

To start this option you have to check “Import” box,

write excise tax rate if applicable within the textbox enabled, and then select

one of the two methods the dropdown box offers to the users:

1)

Data Import

You have to choose the Excel file where you have the

information you want to import, in the dialog window appearing after clicking

on the corresponding dropdown box item, you will see then a similar form to the

previous ones (CPI and Interest rate, Sales, Purchasing import methods), and

also process to follow is quite similar.

First of all, you should put the cells range

containing the data to import in the textbox labeled that way, but here there

is a difference this time in the way the values has to be positioned. They

should be organized in a similar way the application ask for values when using

the manual method, so there are two key factors to have in mind before organize

the information in the Excel worksheet:

I. First column of the

range should contain the name of each expense (with as many rows or fields as

you need).

II. After this first

column, they should follow columns with total amount spent in that overhead for

each period of time (not pairs of columns as in other sections of the program),

with the same number of rows than the first one.

Next step is to write the name of the Excel worksheet

in the next textbox under the previous one.

Then you click on “Import” and wait until the blank table

is filled with the names and numbers in the Excel file (this process could take

long if the selected range is too big).

If everything has worked out correctly and the values

in the table are the ones you wanted, you can click on “OK”, otherwise you can

repeat the process checking the range and name of the Excel worksheet.

2) Time Series

The second item listed in the “Insert data” dropdown

box within import section is “Time Series”. blueSeed Plan provides another calculation method to

estimate total overheads for each period of time (for only one expense each

time). It do it according to historic data trends (data provided by the user),

adding every new obtained value to the original series and using increased set

of values for the calculation of the next period of time rate.

Once you have the Excel file, where you keep the data

series, selected (cells values can only be numbers, this option do not accept

text) you will see a similar form to other sections ones. Here you will first

have to put the cells range in the upper textbox, it can have several rows and

columns, if it has more than one row, the application takes values from left to

right and top to bottom.

Then you write the name of the Excel sheet in the

bottom textbox.

It is important to note that, firstly, the program

asks only for historic overheads figures (not costs and numbers of services to

make a multiplication), and there is no need neither to introduce names of the expenses

in the first column as before (application will assign a default name).

Next thing you click on “Import and calculate” and await

until the blank table is filled with the numbers calculated by the application

(this process could take long if the selected range is too big).

If everything has worked out correctly and the figures

in the table seem to be right, you can click on “OK”, otherwise you can repeat

the process checking the range and name of the Excel worksheet.

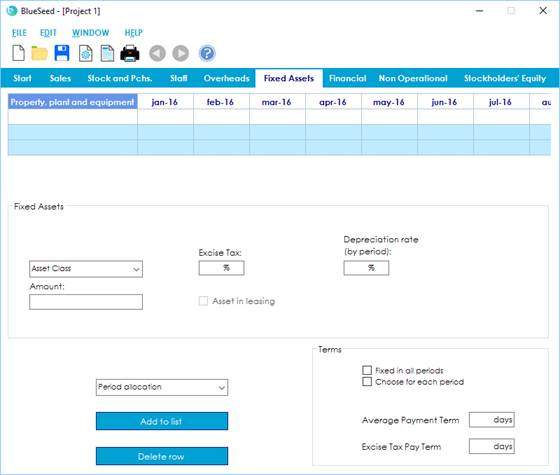

13. Fixed Assets

Below you can see a

screenshot of “Fixed Assets” tab when it is selected by user:

In this one, and some

of the following tabs, gathering information is a little bit different. Application

will not request for data in every period of time, it will just ask for opening

values or references and will automatically calculate the rest in each period, taking

into account all parameters introduced. Also, there is no possibility for data

import.

Again you have a

blank table (with the exception of the headers on every column) where you will

see displayed every data you will be introducing afterwards: name of assets (in

the first column), their end of period value (next columns with the periods

names in the header), average and excise tax pay terms by period of time (which

will be shown in the last two blue rows), excise tax rate by expense (in the

next-to-last column, not seen in the image above) and, finally, depreciation

rate (in the last column of the table, not seen in the image above).

In the case you could not see all the columns or rows

of this table, you can click on it and move through the cells with the arrow

buttons in your keyboard.

So, to load the

information in the table you first have to choose an asset in the list of the

dropdown box called “Asset Class”. Items in the list are: (first intangible

assets) I+D Expenses, Administrative License, Goodwill, ICT Apps; (then

property, plant and equipment) Buildings, Equipment, Furniture, Technical

Facilities, Vehicles and Land.

In the textbox below

you should write asset purchase price or market value (without excise tax). Then

you can write an excise tax rate in the textbox labeled accordingly, if that is

applicable, and finally put the consistent depreciation rate in the last textbox.

If you have used a

leasing contract to support the acquisition of any particular asset, so it is

linked to that financial debt, you should check on “Asset in leasing” box. It

is important you do it because, otherwise, program would already have a

financial debt (leasing) reflected in its reports, and would have another (fixed

asset supplier outstanding debt), at the end of period.

To set the date of

the asset acquisition you, as usual, have to select a period of time in the

dropdown box called “Period allocation” and click on “Add to list” button. After

that the program will calculate asset end of period value, deducting

accumulated depreciation.

Average and Excise Tax

pay terms are added separately selecting one of the two options in the “Terms”

section, fixed for all the project, with means they would be the same terms in

all the periods of time, or you can select to put different terms period by

period (in this case you will see that the dropdown box used to allocate

periods is enabled).

To correct any of the

figures you have already introduced in the table, you only count with one

option this time: you should delete a complete row (or asset) just by selecting

it and clicking on “Delete row” button.

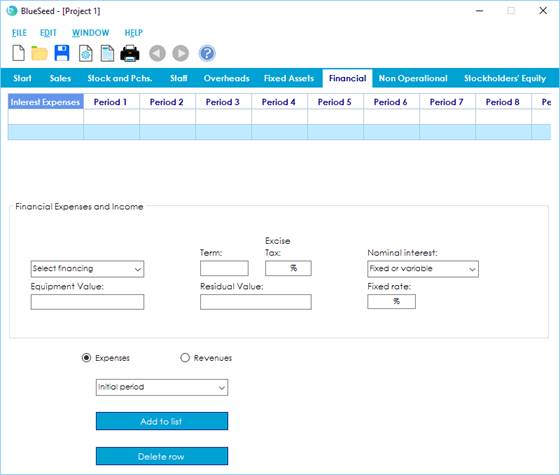

14. Financial

Hereunder you can

find a screenshot of this tab:

Just as in the

previous tab, you have to provide the starting values and parameters of the

selected financial asset or liability, and the application calculates the

resulting data for the rest of the periods.

But first choice to

make is to select between financial expenses or revenues (each kind of data

will be recorded in a different table). For that, we check on the matching

radio button “Expenses” or “Revenues”.

In any choice you

have a blank table (with the exception of the headers on every column) where

you will see displayed every data you will be introducing afterwards: name of

assets or debts (in the first column) and accrued interest receivable or

payable by periods (next columns with the periods of time names in the header).

In the case you could not see all the columns or rows

of those tables, you can click on it and move through the cells with the arrow

buttons in your keyboard.

So to calculate and

display the figures in the tables, either you have selected expenses or

Revenues, you have to choose one item in the first dropdown box in the section.

For “Select financing” box the possibilities are: Leasing (post), Leasing

(pre), Renting, Loan and Credit Account; and for “Type of investment” one the

list is: Fixed term deposit and Loan.

In the textbox below

you can put the amount of the debt (or equipment cost or market value) or the credit.

Then you can set the length of the financial operation itself by write a number

in the “Term” labeled box.

In the cases of leasing

or renting debt operations, there are some other parameters you can make use

of: residual value, other expenses inherent to that operation (for renting), and

excise tax rate. As for Loans you can add a grace period.

But one of the most

important factor in every financial contract is interest. Here, the application

gives you two options:

We can select a fixed

interest for that particular operation, so you will have to pick that item in “Nominal

interest” dropdown box and write an interest rate in the textbox below.

On the other hand, if

you want a variable interest rate for every period, after picking that

selection in the dropdown box, you would have to put a rate differential (it

can be 0) that will sum up to the benchmark rate of our project (which is the

one introduced in the first form when opening a new project, and that is

displayed in “Start” tab).

Lastly, as usual, we

choose opening period for the contract, either debt or asset, and click on “Add

to list”. The program will calculate and display in the table the amount of interests

for that kind of operation in any period to the end of contract term (or project

life if this one is shorter).

To correct any of the

figures you have already introduced in the table, you only count with one

option this time: you should delete a complete row just by selecting it and

clicking on “Delete row” button.

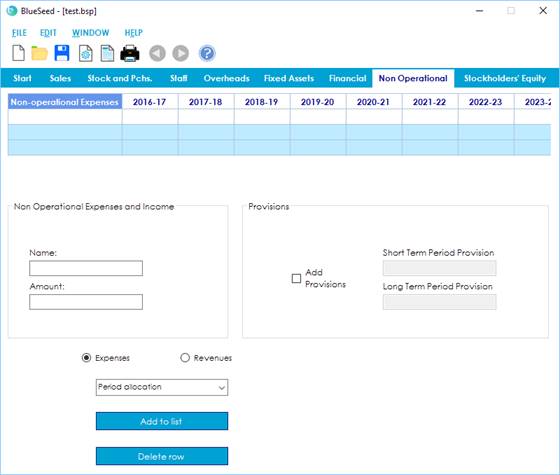

15. Non Operational

Following tab is for

Non Operational expenses or revenues and it has this sight:

In this section you

have to introduce data period by period, in part is like first stages of the

application (but it cannot import values).

What you first see, other

than the usual blank table, is that there are two parts and only one is operational

at the same time, and by default is the first one (the one in the left) which

is enabled. To revert that situation you just have to click on “Add provisions”

box what will deactivate first group and activate “Provisions” one.

Left part of the

section “Non Operational Expenses and Income” is used basically for that, to introduce

non operational values in one of the tables (expenses or revenues), so first

choice to make is to select between them (each kind of data will be recorded in

a different table). For that, we check on the matching radio button “Expenses”

or “Revenues”. Then you have a textbox to write the name of the expense or

revenue and another one to put the amount for a given period of time in.

Finally you select the period in “Period allocation” dropdown box and click on

“Add to list”.

Tables are organized

as in previous tabs, in the first column the name of the expense or revenue

will be shown, and its amounts by period in the following columns. The last two

blue rows are reserved for provisions.

In the case you could not see all the columns or rows

of those tables, you can click on it and move through the cells with the arrow

buttons in your keyboard.

The group “Provisions”

in the right part allow you to manage short and long term provisions, and as

explained before, it has to be activated before start working with it.

After checking on

provisions box, first thing you note is that labels in radio buttons below change

for “Provisions of period” and “Provisions Surplus” accordingly. This make no

difference operationally (as they continue to distinguish between the same

tables you were using before), just announce what kind of provision movement you

are going to carry out, a period provision (equals an expense in income

statement) or a provision surplus (equals a revenue in income statement).

Hence, to copy the

values in the table you have to select one radio button and fill the textboxes

inside the group: figures for short term in the upper one and long term values

in the lower one.

Finally you follow as

usual, you should allocate a period of time in the dropdown box just over the

“Add to list” button and click on the later.

To correct any of the

figures you have already introduced in the table, you only count with one

option this time: you should delete a complete row just by selecting it and

clicking on “Delete row” button.

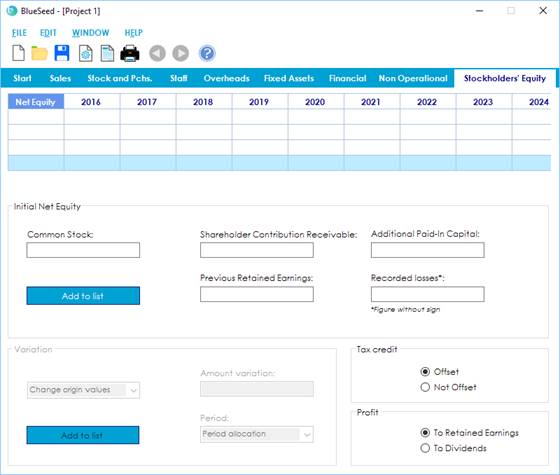

16. Stockholders’ Equity

Last tab, to complete

the introduction of all information needed by the application, has this view:

As you can see in the

previous image, there are several groups where you must put the values you want

to record in the project.

In the first one

“Initial Net Equity”, you see different textboxes you can fill: Common Stock, Shareholders

Contribution Receivable, Additional Paid-In Capital, Previous Retained Earnings

and Recorded Losses.

In all five boxes you

should write opening values for each Net Equity field (those quantities should

be the same the ones you have in starting balance sheet of the new project).

Common Stock value is

a must you should fill, to have intelligible reports and to calculate some of

the financial ratios this program offers (as IRR). The applications offers the

opportunity to add capital increases after first period, as you will see later.

Rest of the textboxes

are optional to fill. Shareholders Contribution Receivable and Additional

Paid-In Capital values can be modified after having set opening values, as you

will see later. Movements in this variables would then affect to cash flow

report or to financial rates too.

Previous Retained

Earnings and Recorded Losses can be left blank, in the case your Project is related

to a new undertaking, or use the figure in balance sheet in the case of ongoing

companies.

Once you have written

all the initial values you want to record, just click on the upper “Add to list”

button to display them in the table. This action also enable the second group

of controls “Variation”, and disable the first one (there is an option to come

back to this group as you will see later).

In the case you could not see all the columns or rows

of this table, you can click on it and move through the cells with the arrow

buttons in your keyboard.

Now, in this group

you first can appreciate a dropdown box which has four options to choose:

Common Stock Increase, Additional Paid-In Capital, Shareholder Contribution Receivable

Deposit and Change Origin Values.

So, to make changes

in the displayed numbers, we have to select one of the first three items, last

one just disable this section and returns you to the first one. Then, write the

variation amount in the next textbox and, finally, allocate the period of time

when this adjustment would happen. Last of all you just have to click on “Add

to list” in this group, and the program will recalculate the balance of every

field on the table taking into account the new adjustments, and new values will

display in the table.

Last parts of the tab

are two sections where you can take decisions about tax credit and retained

earnings.

Within “Tax credit”

section, you have two options to choose: Offset or Not Offset negative tax

bases (coming from previous periods). If you choose to offset tax bases, any period

you have an income tax positive quota it will be diminish in the corresponding

amount. In the case you choose not to offset tax bases, any negative new tax

base will be added to Recorded Losses in balance sheet.

In conclusion, within

“Profit” section, you can choose destination of earnings surpluses in every

period of time, and you have two options: To Retained Earnings and To Dividends.

If you choose first choice, every net income would add to Retained Earnings in

the balance sheet (increasing net equity total amount). On the other hand, if

you decide to distribute dividends,

the program considers there is cash outflow (and there is no increasing in net

equity).

17. Reports View / Print (  /

/  )

)

Most important

utility of blueSeed Plan is the production of several kind of reports, graphics

and financial ratios using all the information you have introduced in every

stage in the application.

Reports can be viewed

in the screen, for what you have to click on button ![]() in the toolstrip, or can be sent directly to printer just by

clicking on button

in the toolstrip, or can be sent directly to printer just by

clicking on button ![]() (there is the possibility to export to an

Excel file as you will see later).

(there is the possibility to export to an

Excel file as you will see later).

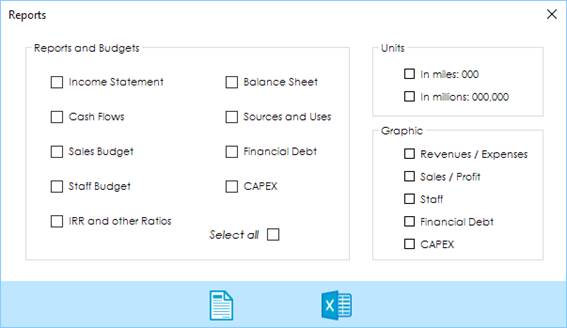

After clicking on any

of the described buttons, a new dialog window will appear (as it is shown in

the following image), where you can select which reports, budgets, graphics you

want, and in which units they will be displayed.

Once we have chosen

the reports we want to see or print by checking on the matching box, you have

to click on one of the two buttons this window shows: view at the screen ![]() or print

or print

![]() it (depending on the choice you have done in

prior step), and export to Excel file

it (depending on the choice you have done in

prior step), and export to Excel file ![]() .

.

18. Full Screen

Usually, tables

displaying data in every tab of the main form are not big enough to see all their

rows or columns, therefore not having all information at only one view. To somewhat

sort this out, you can double-click on any table and it will be rendered in

full screen.

In some cases: Fixed

Assets, Financial and Stockholders’ Equity, you will see more information in this

mode than when not using full screen. This data, though used by the application

to make up the reports, is made not visible by the program to try to summarize the

most significant values in tab table smaller area.

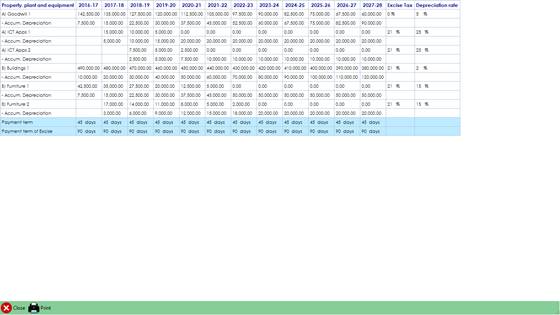

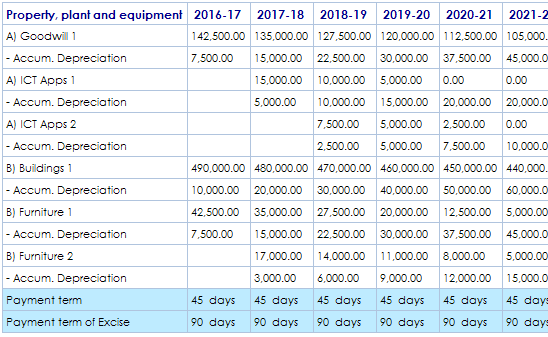

For instance, if you

double-click in “Fixed Assets” tab table, you will see something like this

image hereunder:

And a clearer detail

of it would be:

Here you can see

that, below the row of every fixed asset, there is another with the related

accumulated depreciation.